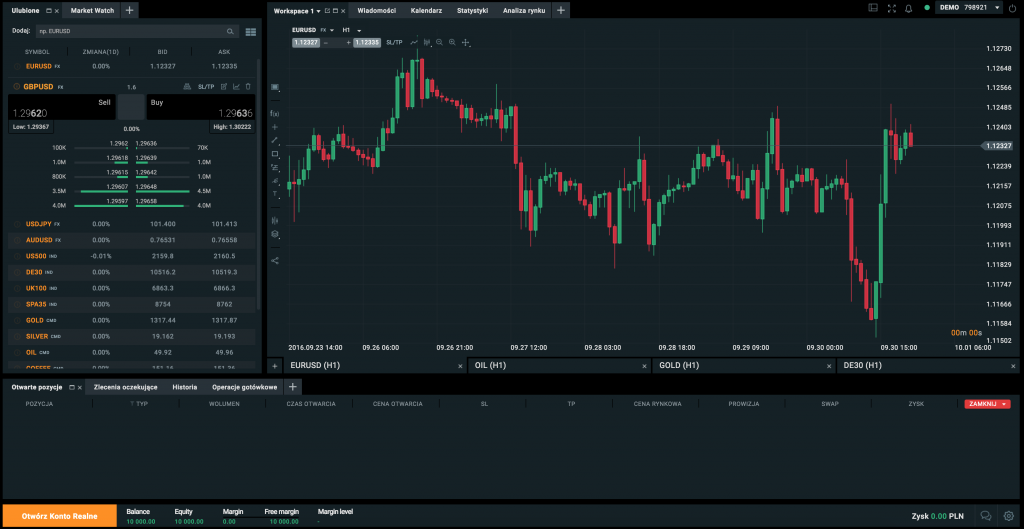

ThinkMarkets spreads start from as low as 0.1 pips on EUR/USD, even under volatile market conditions. ThinkMarkets takes a fee from the spread which is the difference between the buy and sell price of an instrument. ThinkMarkets allows you to trade currencies with leverage up to 400:1. Thinkmarkets is a MetaTrader broker and has its own proprietary trading platform, ThinkTrader. The brokerage is perfectly suitable for beginner, intermediate and advanced traders looking for quick and easy access to the markets via MT4, MT5 or a proprietary platform as well as low forex and non-trading fees. Thinkmarkets is recommended for retail traders who are interested in trading multiple financial assets, including forex and CFDs.

Thinkmarkets is the trading name of TF Global Markets (UK) Ltd.įCA Financial Conduct Authority, United KingdomįSCA Financial Sector Conduct Authority, South AfricaĪSIC Australian Securities and Investments Commissionĭoes Thinkmarkets accept forex traders in South Africa? Melbourne, Australia (Primary headquarters)

The regulatory authorities are the FCA in the UK, FSCA in South Africa and ASIC in Australia. ThinkMarkets is regulated by three esteemed financial authorities and is regarded as reliable, secure and safe to use by forex traders in South Africa.

Thinktrader vs metatrader driver#

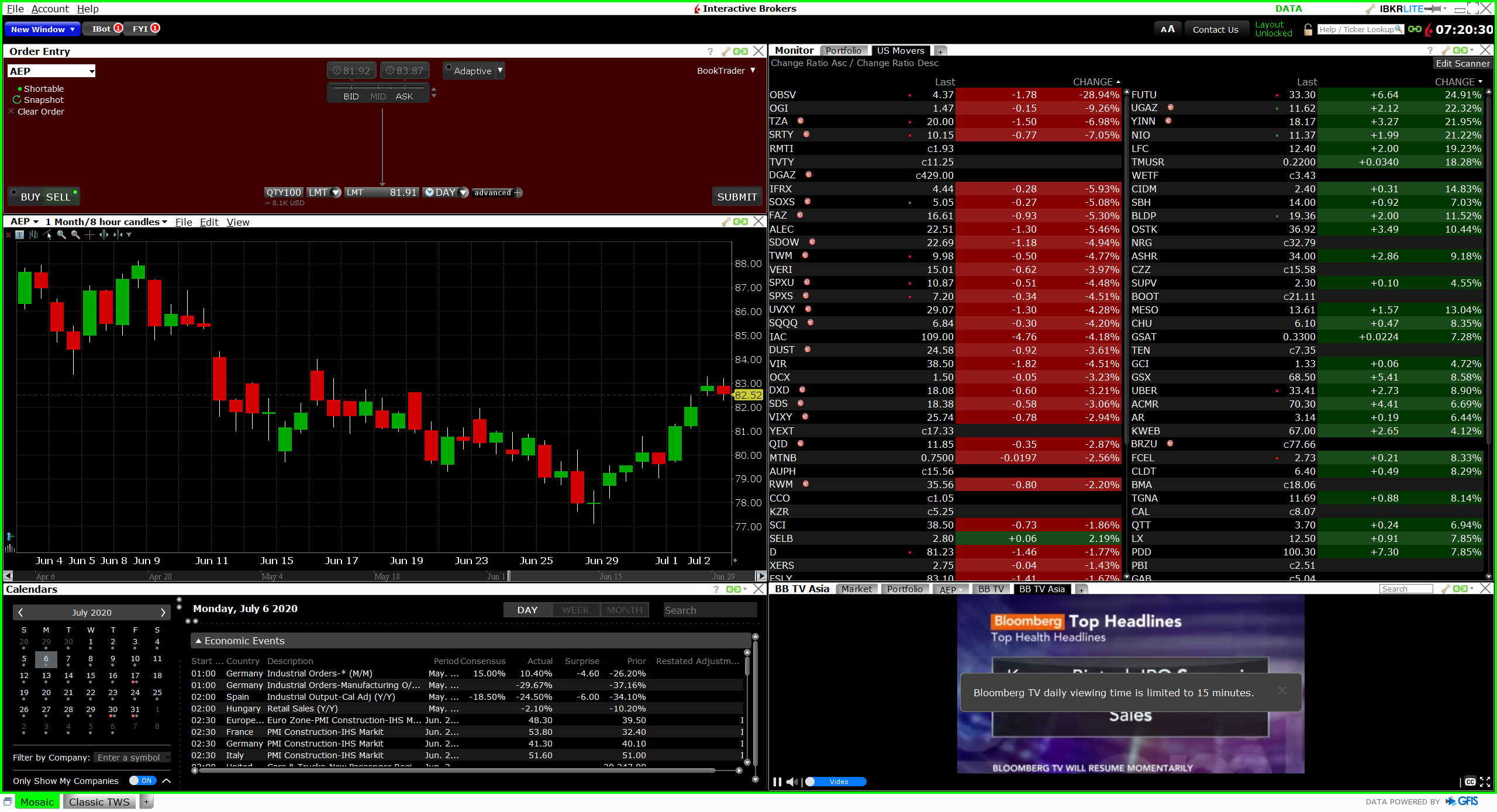

Technology and client education is a key driver of growth and development at ThinkMarkets. ThinkMarkets maintains some of the most competitive trading conditions in the market, including tight spreads, low to zero commissions and a variety of account types. The brokerage’s product offering is supported by the latest trading technology, best pricing and superior execution speed. It recently received the esteemed award for Best Mobile Platform by the forex community. ThinkMarkets is a MetaTrader (MT4 and MT5) broker and also has its own proprietary trading technology, ThinkTrader. ThinkMarkets offers retail and institutional clients quick and easy access to a wide range of markets, including forex, CFDs on equities, cryptocurrencies, commodities, indices and shares. The company was rebranded as ThinkMarkets in 2016 to reflect its evolving product range and its position in the market as a true multi-asset provider. TF Global Markets was created by brothers Nauman Anees and Faizan Anees as a currency derivatives provider in 2010 originally trading as ThinkForex. The company is located in Melbourne, Australia and has offices in South Africa, the United Kingdom, the Asia-Pacific, Middle East and North Africa, Europe and South America. ThinkMarkets is a well-established international forex and CFDs brokerage. You can minimise the risk by trading through a regulated forex broker who you can trust. Forex is traded over-the-counter through a network of brokers and financial institutions as opposed to a centralised exchange. To trade forex in South Africa, you need to open an account with a regulated broker. We provide valuable information on the platforms, analysis and tools as well as pricing for you to base your decision on when choosing the right broker for your trading needs. © 2022 This website is owned and operated by ThinkMarkets Group.Forex Trading Africa annually reviews forex brokers regarded as the best in the world who accept South African traders. The information on this site is not directed at residents of the United States, Canada, Japan, France, Belgium, Russia or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Registered address: Hana, 4th Floor, 70 St Mary Axe, London EC3A 8BE. TF Global Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority, FRN 629628. Tax law may differ in a jurisdiction other than the UK. Tax laws depend on individual circumstances and may differ in a jurisdiction other than the UK.

Thinktrader vs metatrader professional#

Please ensure you fully understand the risks associated with a professional trading account. Risk warning for qualified professional traders: Derivative products are leveraged products and can result in losses that exceed initial deposits.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. 68.66% of retail investor accounts lose money when trading CFDs with this provider. Risk warning for retail traders: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

0 kommentar(er)

0 kommentar(er)